Critical Illness Insurance

Things to do in case of Critical Illness Insurance compensation

| 1. | In the event of a claim, you must notify the following telephone number immediately (if any).

Claim Hot Line– 09 940777888 |

|

| 2. | Attach the following documents with the Critical Illness Insurance claim form: | |

(A) In case of death

|

||

(B) Treatment of severe disease

|

||

Frequently Asked Questions

Who can buy Critical Illness Insurance?

Those aged between 6 and 60 years (individually or in a group) can buy Critical Illness Insurance.

How the insurance period for Critical Illness Insurance?

The period for Critical Illness Insurance is one year.

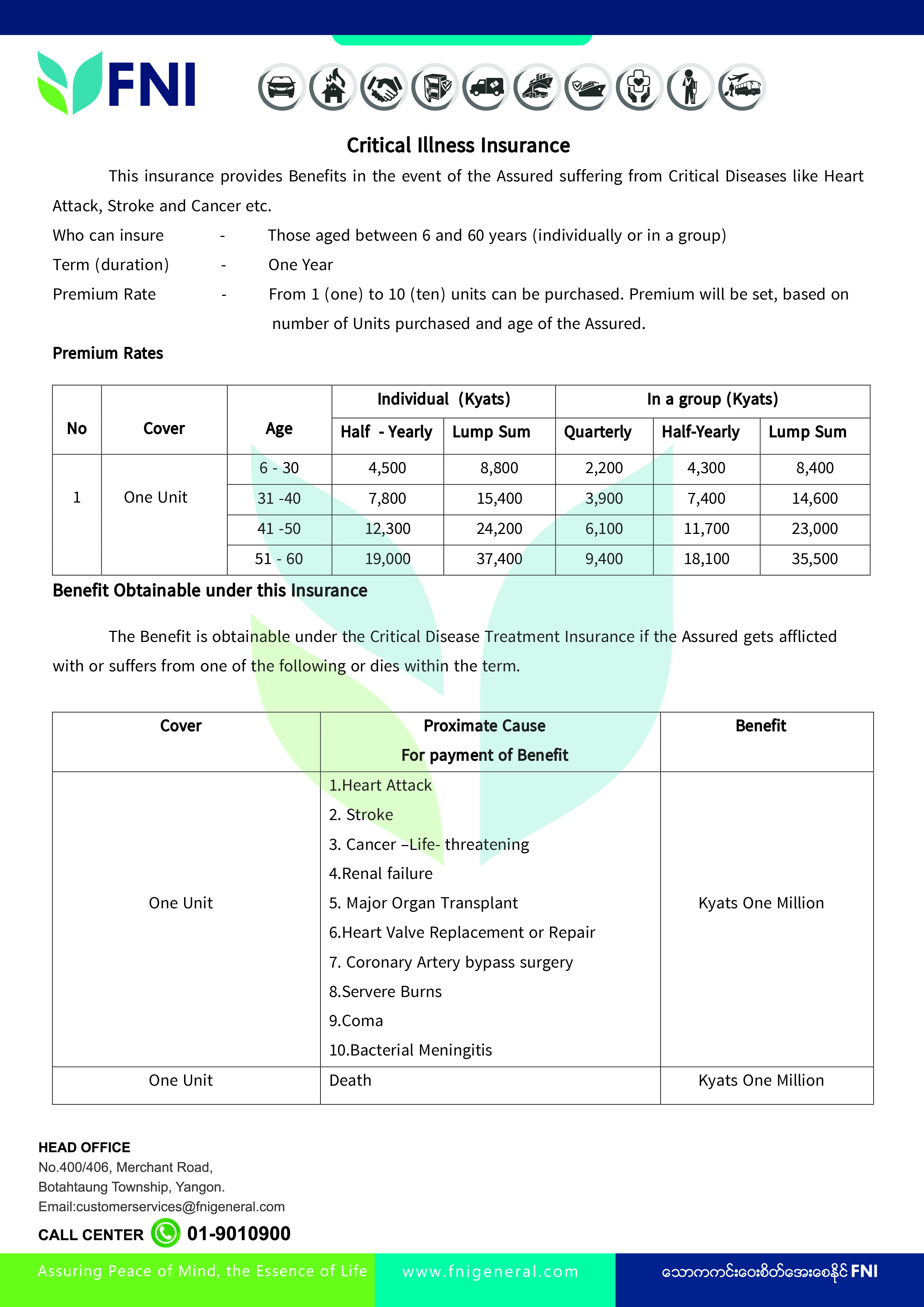

How the sum insured does for Critical Illness Insurance is determined?

In Critical Illness Insurance, premium unit can be purchased from a minimum 1 to a maximum of 10 units, and premium will be set, based on number of Units purchased and age of the Assured.

What are the benefits of buying Critical Illness Insurance?

This Insurance provides Benefits in the event of the Assured suffering from Critical Diseases like Heart Attack, Stroke and Cancer etc.

How to pay the premium for individual customers who buy Critical Illness Insurance?

In Critical Illness Insurance, individual customers can pay the premium Half-Yearly or as a Lump sum.

How to pay the premium for group customers who buy Critical Illness Insurance?

In Critical Illness Insurance, group customers can pay the premium Quarterly or Half-Yearly or as a Lump sum.

What types of illnesses can be reimbursed if you have an unexpected medical condition in Critical Illness Insurance?

The Benefit is obtainable under the Critical Disease Treatment Insurance if the Assure gets afflicted with or suffers such as Heart Attack, Stroke, Cancer-Life-threatening, Renal Failure, Major Organ Transplant, Heart Valve Replacement or Repair, Severe Burns etc.

What is death benefit for Critical Illness Insurance?

In Critical Illness Insurance, can receive a benefit of One Million MMK per unit for Death.

Can compensation be denied under Critical Illness Insurance?

In Critical Illness Insurance, if the condition has already been paid for an unexpected serious illness, the insurance contract will be terminated and the death benefit will not be available.

Is there any exclusion to Critical Illness insurance?

In Critical Illness Insurance, no Benefit is obtainable for the affliction with or suffering from a Critical Disease or Death directly or indirectly caused by such as Suicide or intentional self-injury, Fraudulent claims, Physical defect or infirmity, Use of a narcotic drug, Self-commission of a criminal offence, Contraction of AIDS/ HIV, Beautification etc.

coming soon!