Health Insurance

Things to do in case of Health Insurance compensation

| 1. | In the event of a claim, you must notify the following telephone number immediately (if any).

Claim Hot Line – 09 940777888 |

|

| 2. | Attach the following documents along with the health insurance claim. | |

(A) In case of death

|

||

(B) If you are hospitalized due to illness / accident

|

||

(C) In case of surgery

|

||

(D) In case of miscarriage

|

||

(E) If hospital / clinic is shown

|

||

Frequently Asked Questions

Who can buy Health Insurance?

Those aged between 6 and 75 years (individually or in a group) can buy Health Insurance.

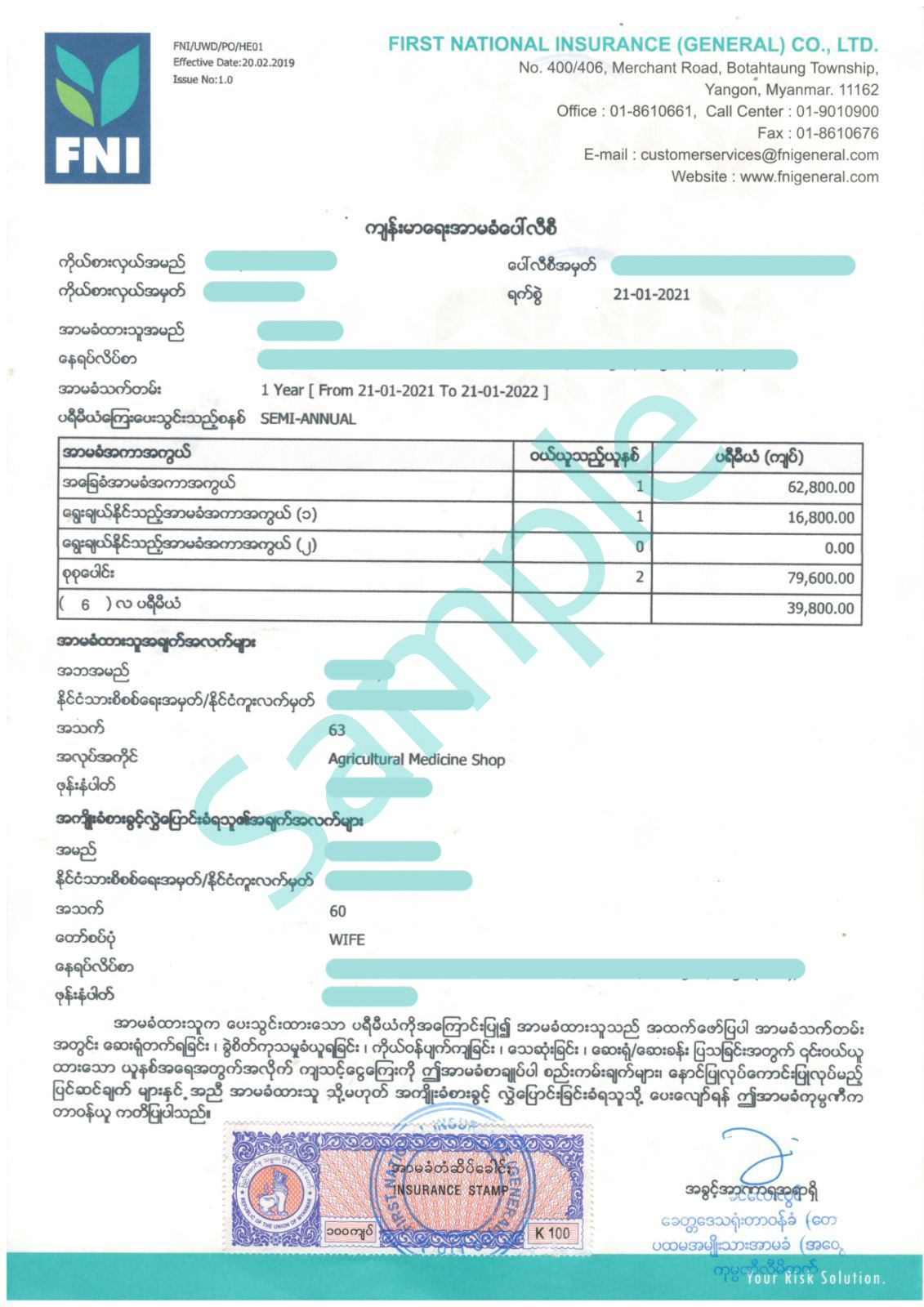

What are Health Insurance periods?

Health Insurance period is only one year.

How Health Insurance premiums are determined?

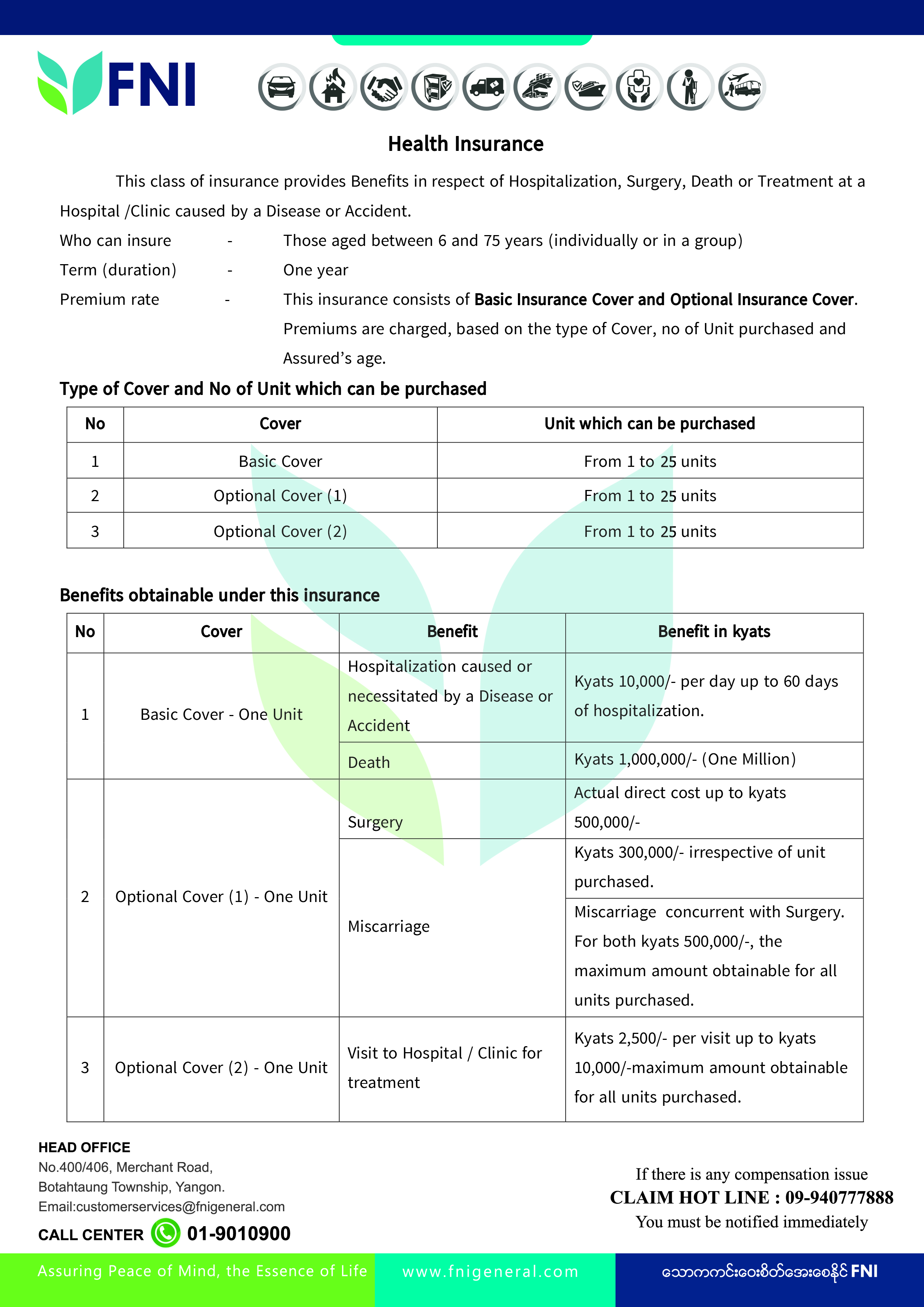

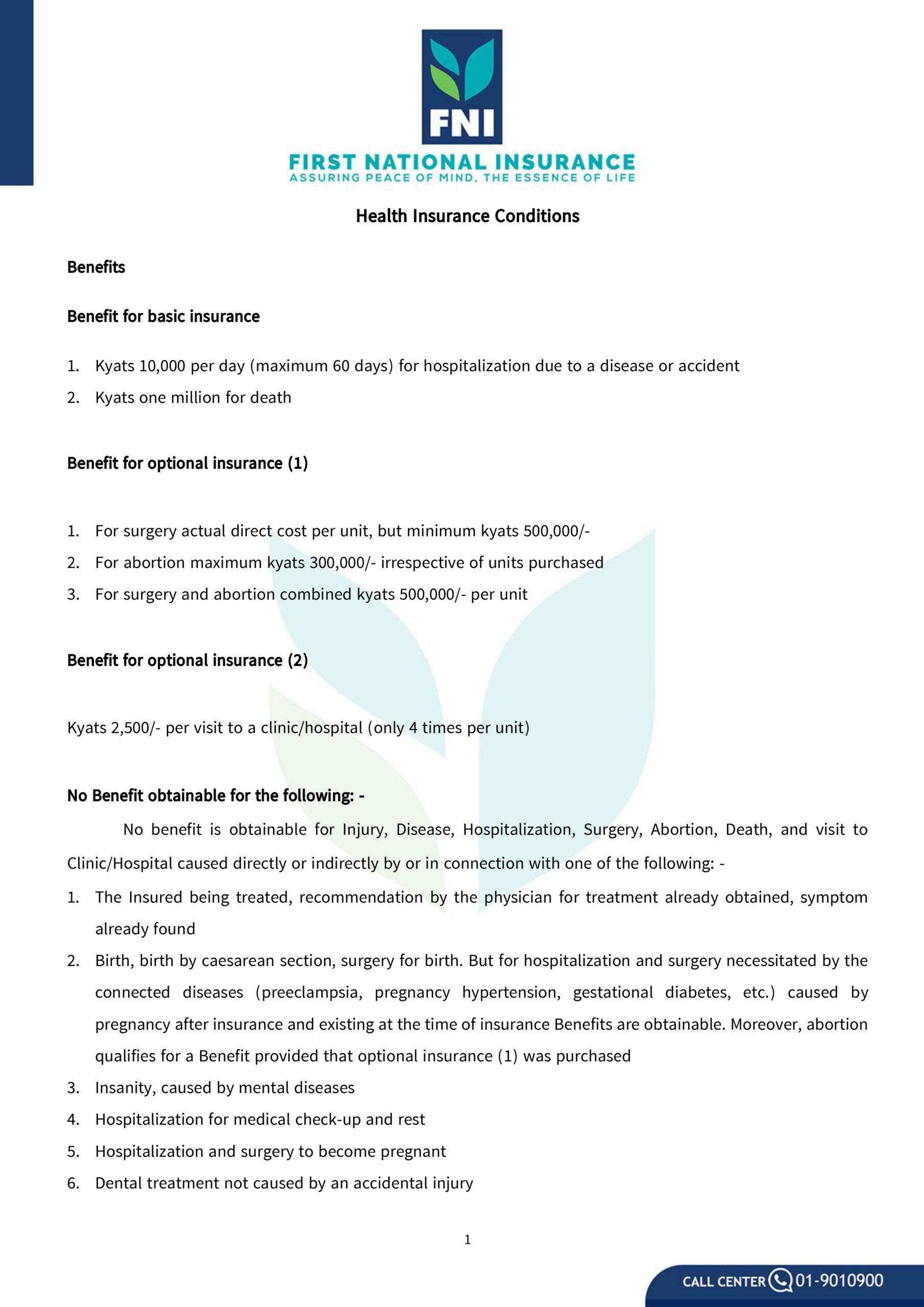

Health Insurance consists of Basic Insurance Cover and Optional Insurance Cover. Premiums are charged, based on the type of Cover, number of Unit purchased and Assured's age.

What type of insurance is Health Insurance?

Health Insurance provides Benefits in respect of Hospitalization, Surgery, Death or Treatment at a Hospital/ Clinic caused by a Disease or Accident.

How Health Insurance can be purchased by customers?

Health Insurance can be purchased by customers as Basic Cover, Optional Cover 1 and 2 from 1 unit to 10 units.

Can an insured buy optional cover separately?

Only Basic Cover and Not Optional Cover can be purchased singly. Optional Cover units can be purchased only up to the number of units purchased for Basic Cover.

What are the benefits of purchasing Basic Cover in Health Insurance?

Health Insurance provides Basic Cover a minimum MMK 10,000/- per day up to 60 days of hospitalization due to Hospitalization caused or necessitated by a Disease or Accident; insured can receive death benefit one million MMK for accidental death.

What are the benefits of purchasing Optional Cover 1 in Health Insurance?

Health Insurance provides Actual direct cost up to MMK 500,000/- due to Surgery and MMK 300,000/- irrespective of unit purchased by Miscarriage.

What are the benefits of purchasing Optional Cover 2 in Health Insurance?

Health Insurance provides MMK 2,500/- per visit up to MMK 10,000/- maximum amount obtainable for all unit purchased due to Visit to Hospital/ Clinic for treatment.

coming soon!