Travel Insurance

Things to do in case of Travel Insurance compensation

| 1.

|

In the event of a claim, you must notify the following telephone number immediately (if any).

Claim Hot Line– 09 940777888 |

| 2. | Attach the following documents along with the Travel Insurance claim form |

(A) In case of death

|

|

(B) Persons with permanent disability

|

|

(C) In case of injury

|

|

(D) If you are hospitalized / treated

|

Frequently Asked Questions

Who can purchase Travel Insurance?

Travel Insurance can be purchased by Domestic/Overseas Travelers by Flight, Ship, Private Car or Rental Car.

What are Travel Insurance period of coverage?

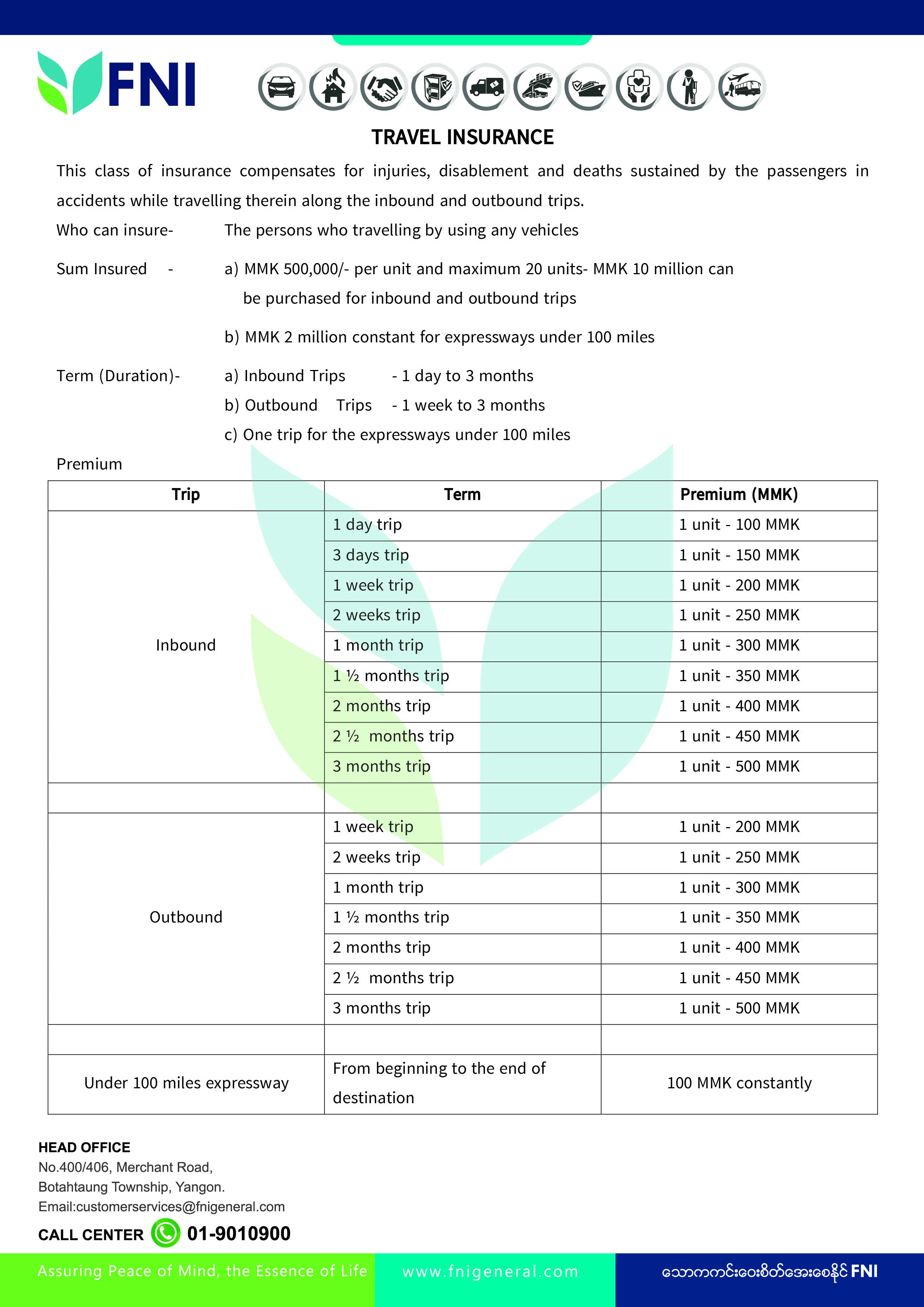

In Travel Insurance, for domestic trip period of coverage is set from a minimum of 1 day to a maximum of 3 months and oversea trip is set from a minimum of 1 week to a maximum of 3 months.

How Travel Insurance premium is set?

In Travel Insurance, the premium is set from a minimum of 100 MMK to a maximum of 500 MMK per unit, with a maximum of 20 units per person.

Who can purchase Travel Insurance?

Travel Insurance can be purchase by passengers, domestic/overseas trips by flight, ship, private car or rental and public transportation.

What type of insurance is Travel Insurance?

Travel Insurance covers domestic or overseas travelers who are injured, become permanently disable or died while traveling due to an accident.

What are the benefits of having Travel Insurance?

If the insured get an injury, permanent disability and death in an accident during the trip, the insured is entitled to receive the compensation.

How can an insured receive Travel Insurance benefits, if an insured suffered permanent disability due to an accident?

In case an insured suffered 100% permanent disability, the insured is entitled to receive permanent disability benefits in lump sum, after the doctor recommendations.

What are the factors that exclude covers from Travel Insurance?

1. Existing disablement or diseases

2. Suicide

3. Intentional Self-Inflicted Injury

4. Committing criminal offences

The Travel Insurance excludes these offences.

How Travel Insurance provide cover for hospitalization and treatment of injury?

Domestic/ Oversea maximum compensation for hospitalization/ treatment expenses are 4000 MMK per unit per week (from 1 week to 52 weeks), and under 100 miles trip compensation is 3200 MMK per unit per week (from 1 week to 52 weeks).

How to claim for Travel Insurance benefits?

Within 1 year of occurrence for death claims, injury claims can be claimed within two years.

coming soon!