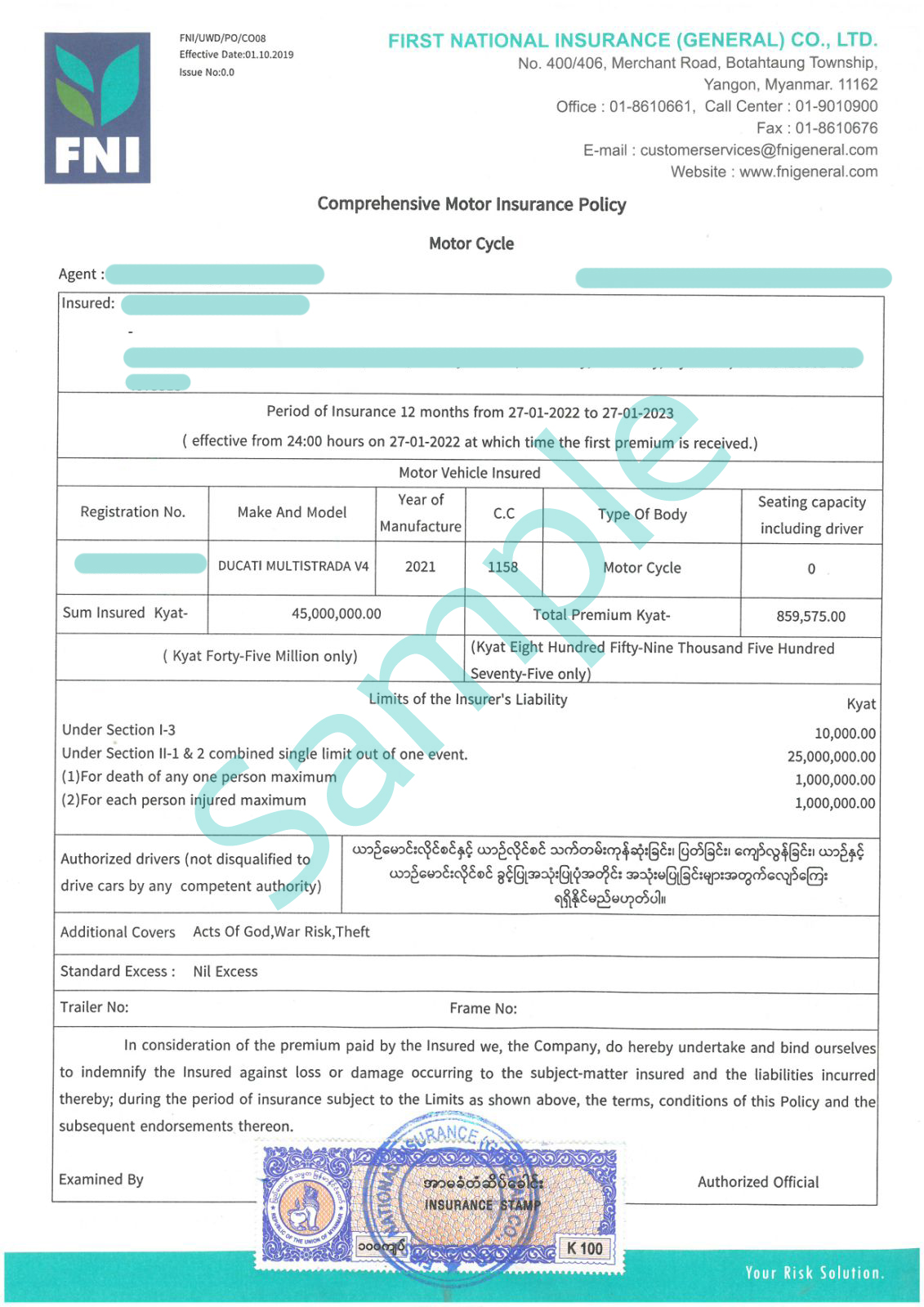

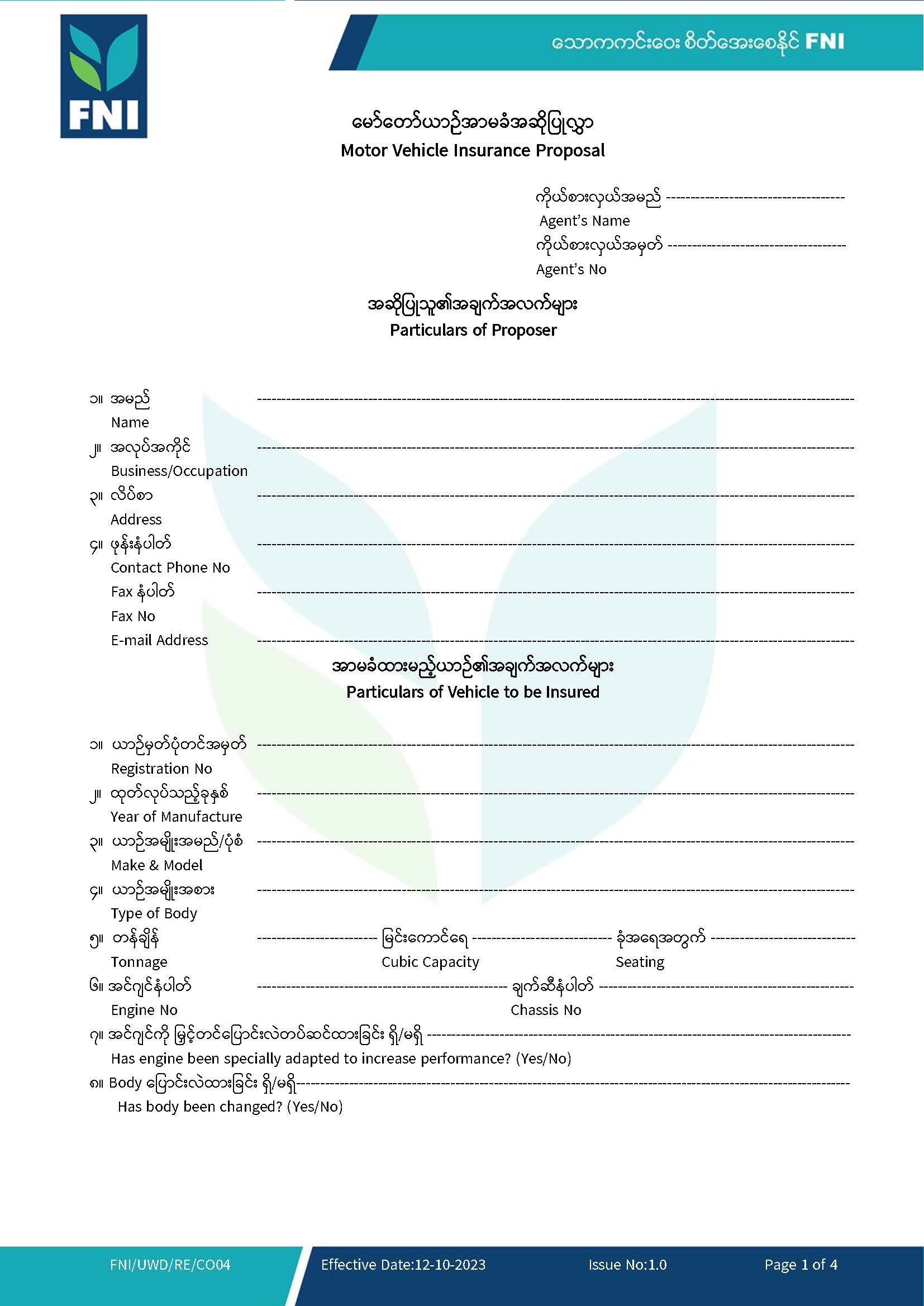

Motor Vehicle Insurance

Array

Things to do in case of Motor Vehicle Insurance compensation

| 1. | In the event of an accident, the following telephone number should be notified immediately (in case of immediately). |

||

| Claim Hot Line – 09 940777888 | |||

| 2. | The following documents are required to claim compensation

|

||

Frequently Asked Questions

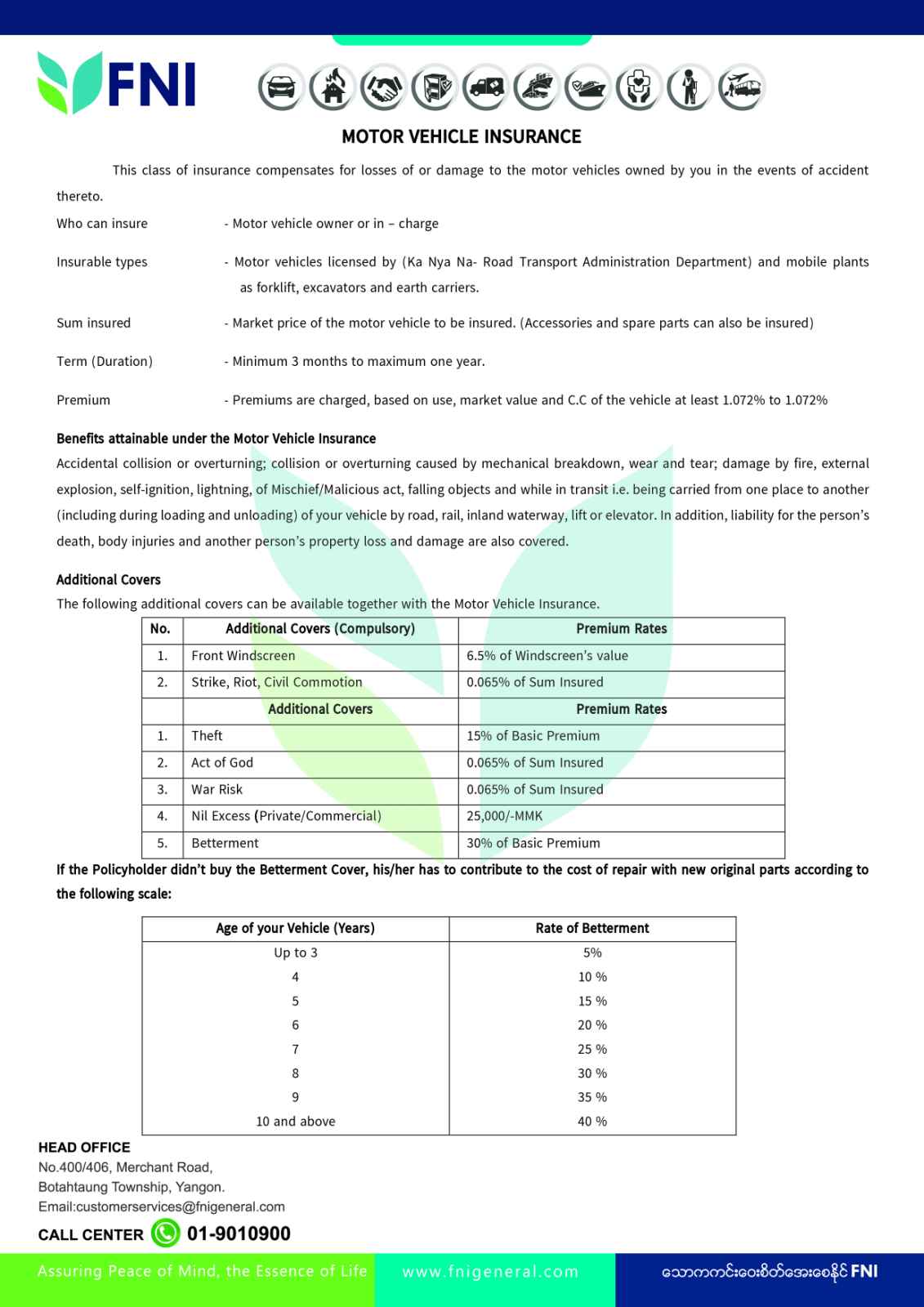

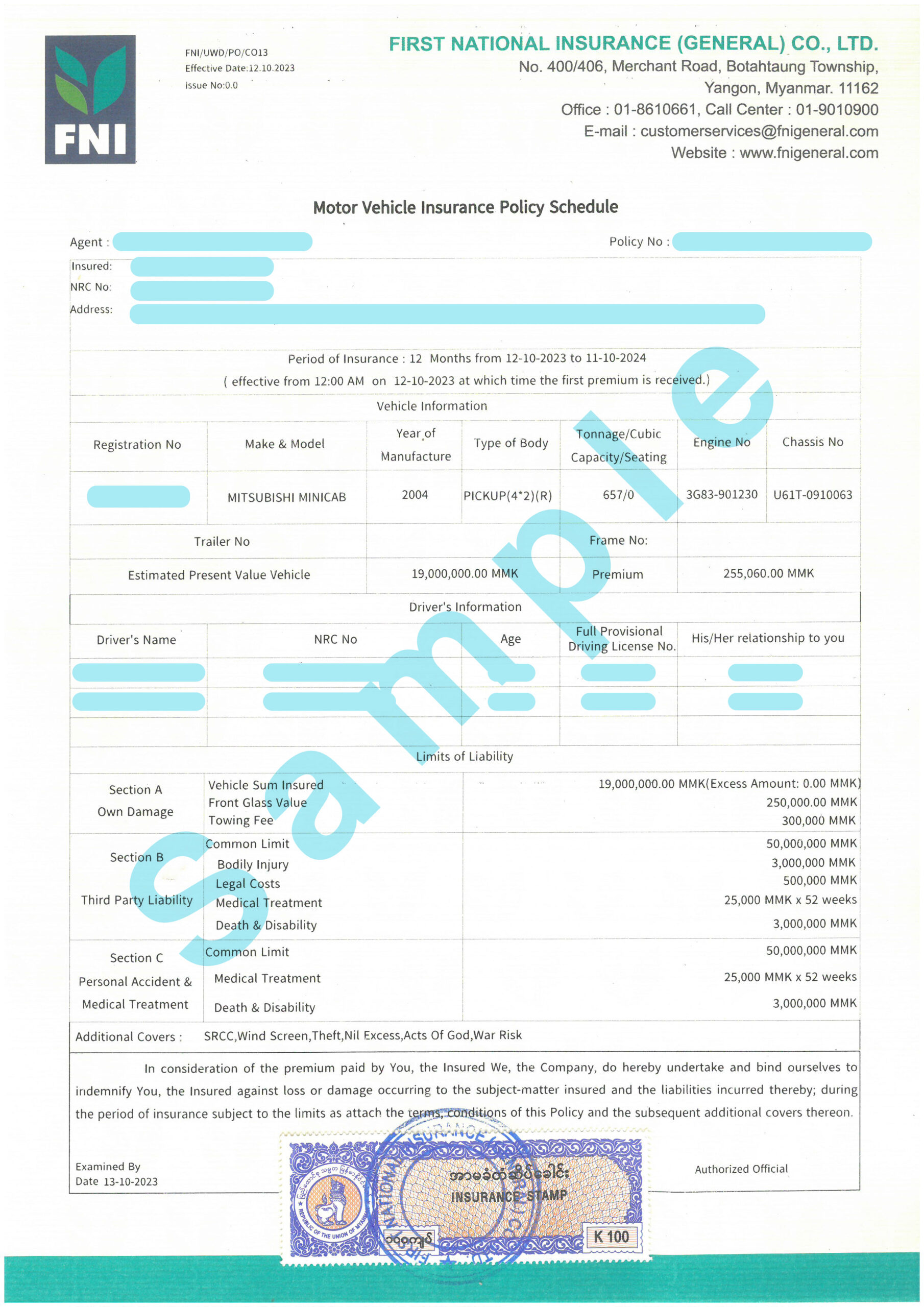

How the premiums of Motor Vehicle Insurance are calculated?

Motor Vehicle insurance premiums are charged, based on use and C.C of the vehicle.

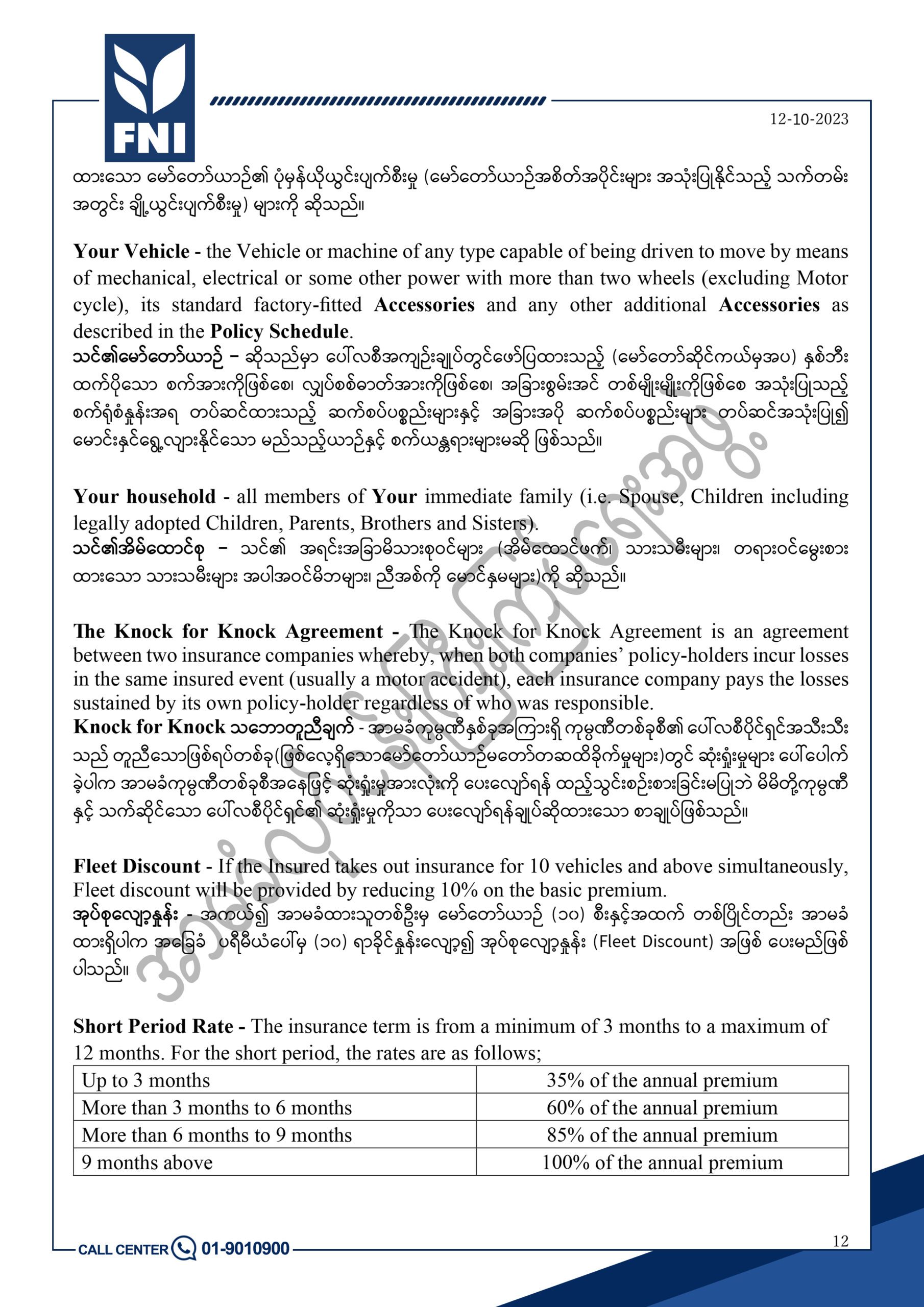

What are the periods for Motor Vehicle Insurance?

The insurance periods for Motor Vehicle Insurance are a minimum of 3 months to a maximum of 1 year.

What types of motors are available for Motor Vehicle Insurance?

Motor vehicles licensed by (Ka Nya Na – Road Transport Administration Department) and mobile plants such as forklift, excavators and earth carriers.

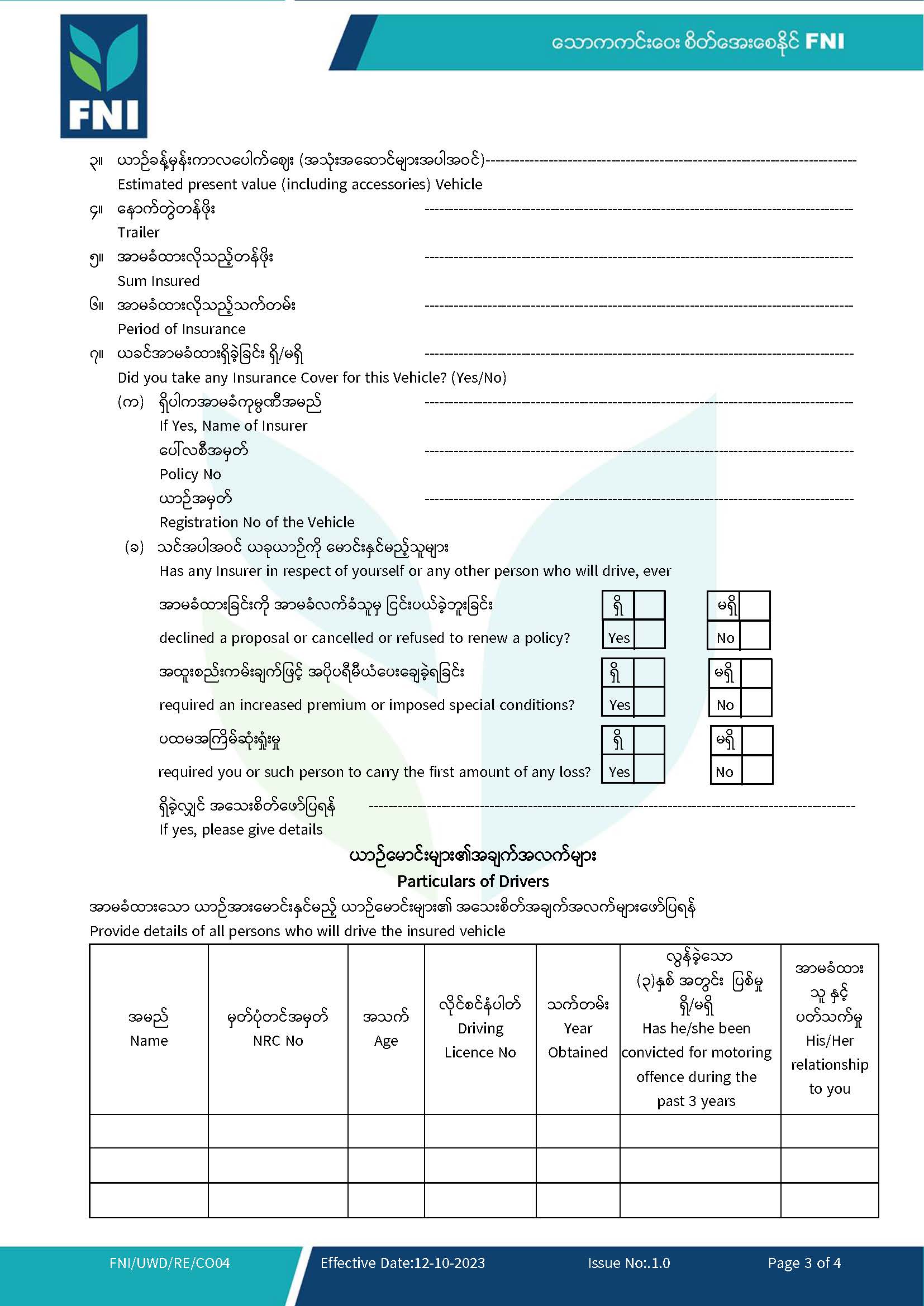

What are the requirements for Motor Vehicle Insurance?

The requirements for Motor Vehicle Insurance are –

True copy of the Owner Book (valid), in the absence thereof true copy of import license stamped with vehicle registration number and true copy of Wheel Tax.

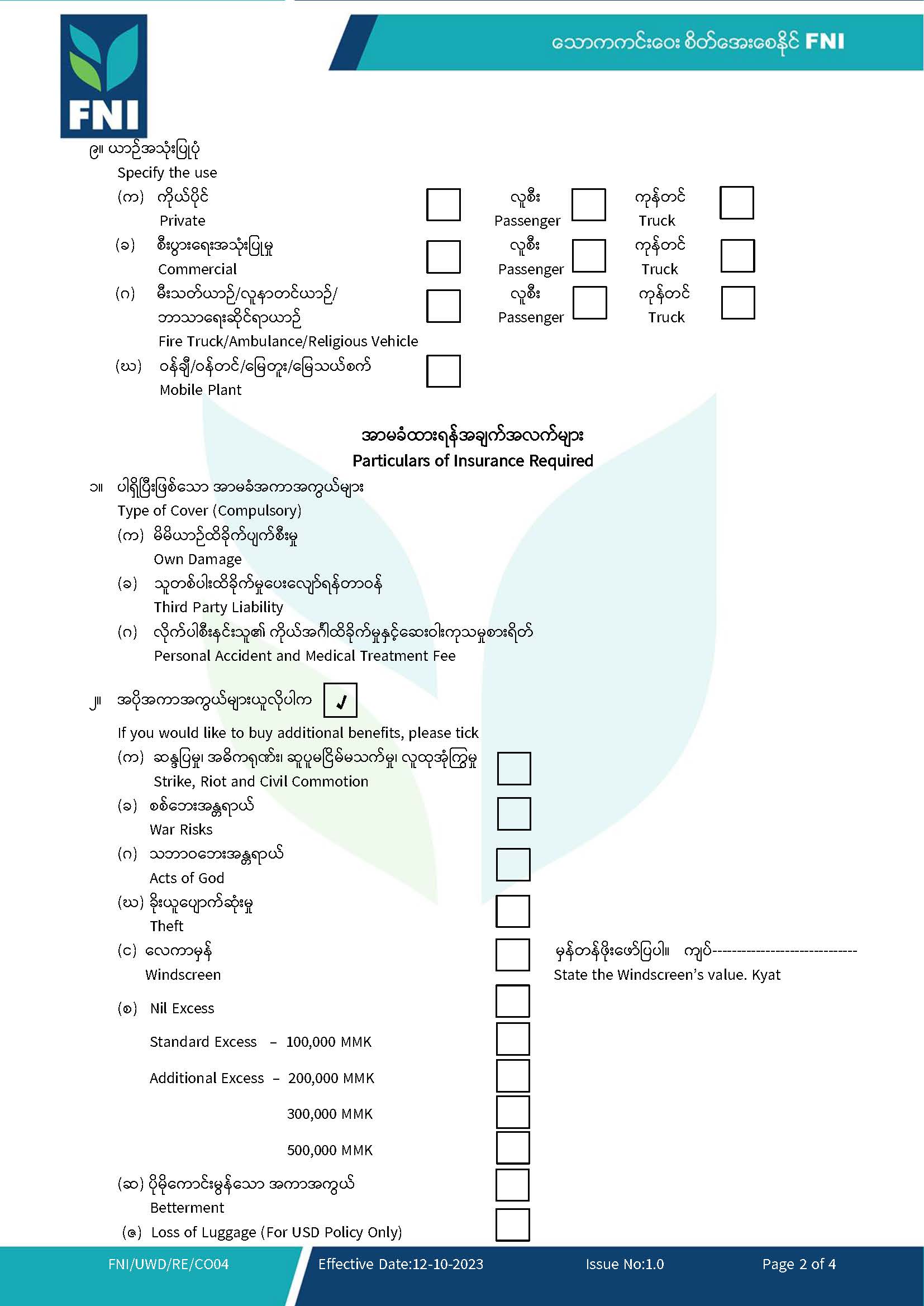

Is there any extra coverage for Motor Vehicle Insurance?

War Risk, Acts of God, Theft of the Vehicle, Wind Screen Glass such as extra (4) types of insurance can be purchased by Motor Vehicle Insurance.

What type of insurance is Motor Vehicle Insurance?

This class of insurance compensates for losses of or damage to the motor vehicles owned by you in the events of accident thereto.

Who can purchase Motor Vehicle Insurance?

Motor vehicle owner or in-charge can purchase Motor Vehicle Insurance.

What are the benefits of purchasing Motor Vehicle Insurance?

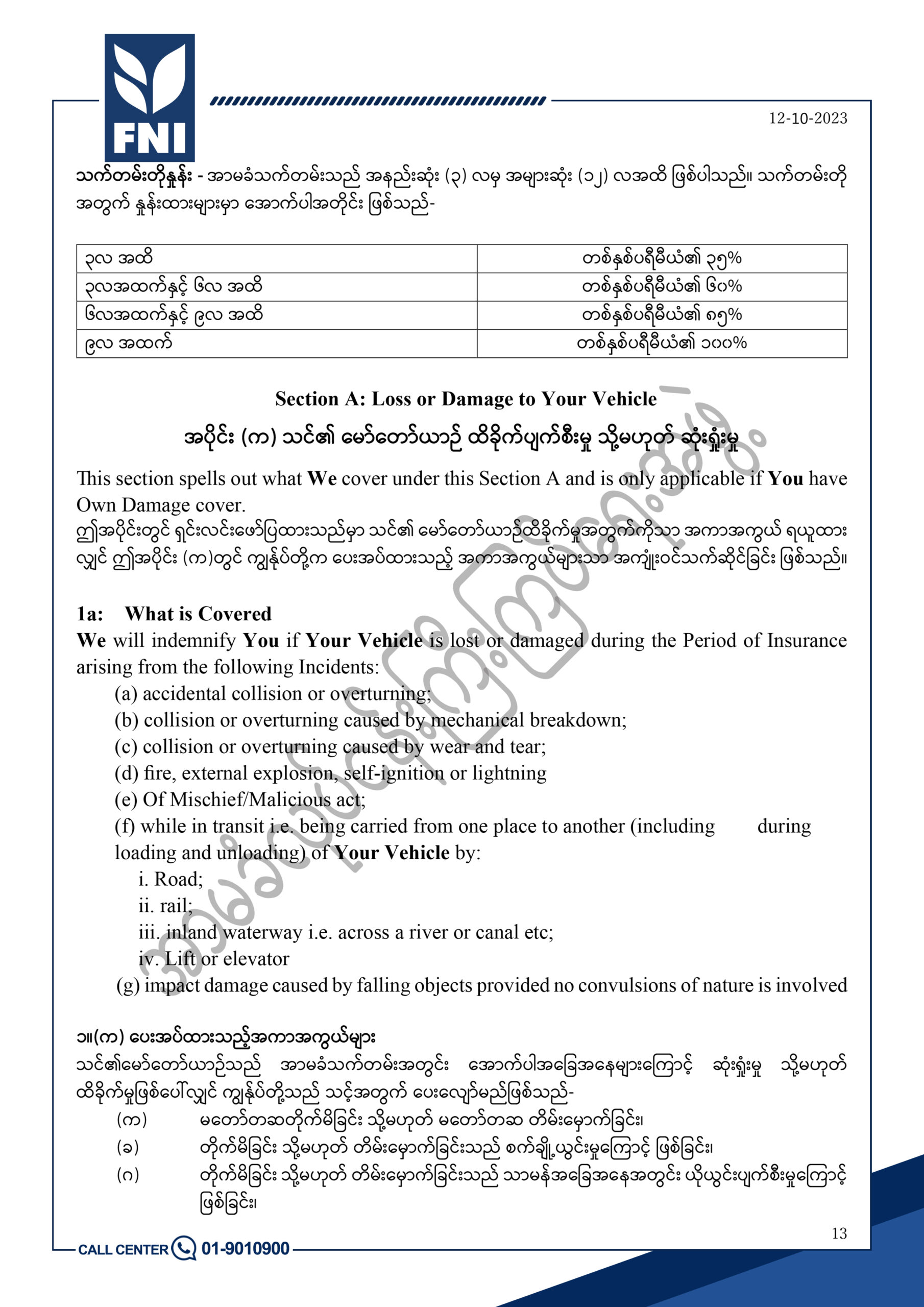

Collision and Overturning, Damage by Fire, External Explosion, Self-Ignition, Lightning, Malicious Act, Falling Objects, Strike, Riot and Civil Commotion are covered. In addition deaths, injuries and damage to properties caused to Third Parties are also covered.

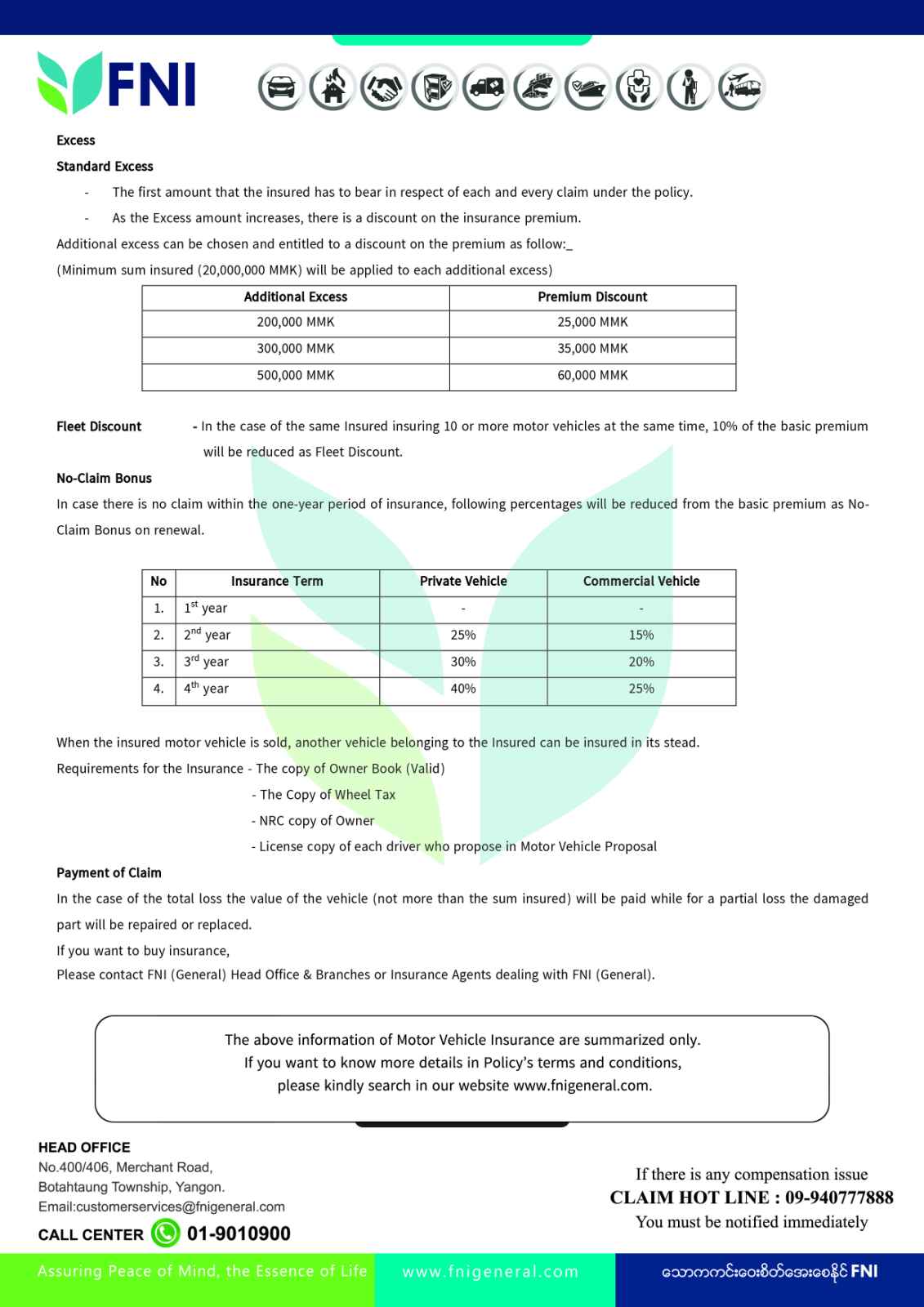

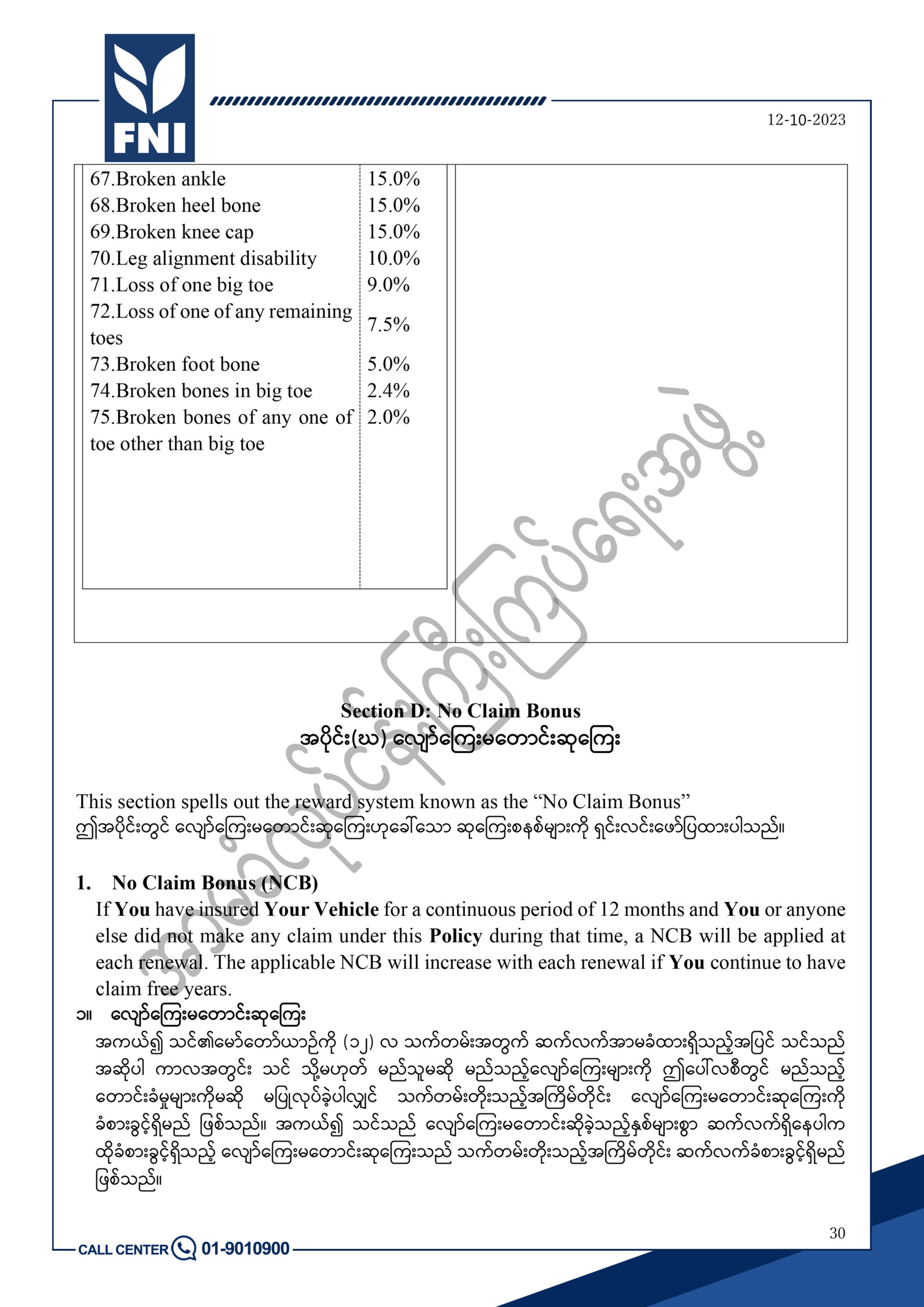

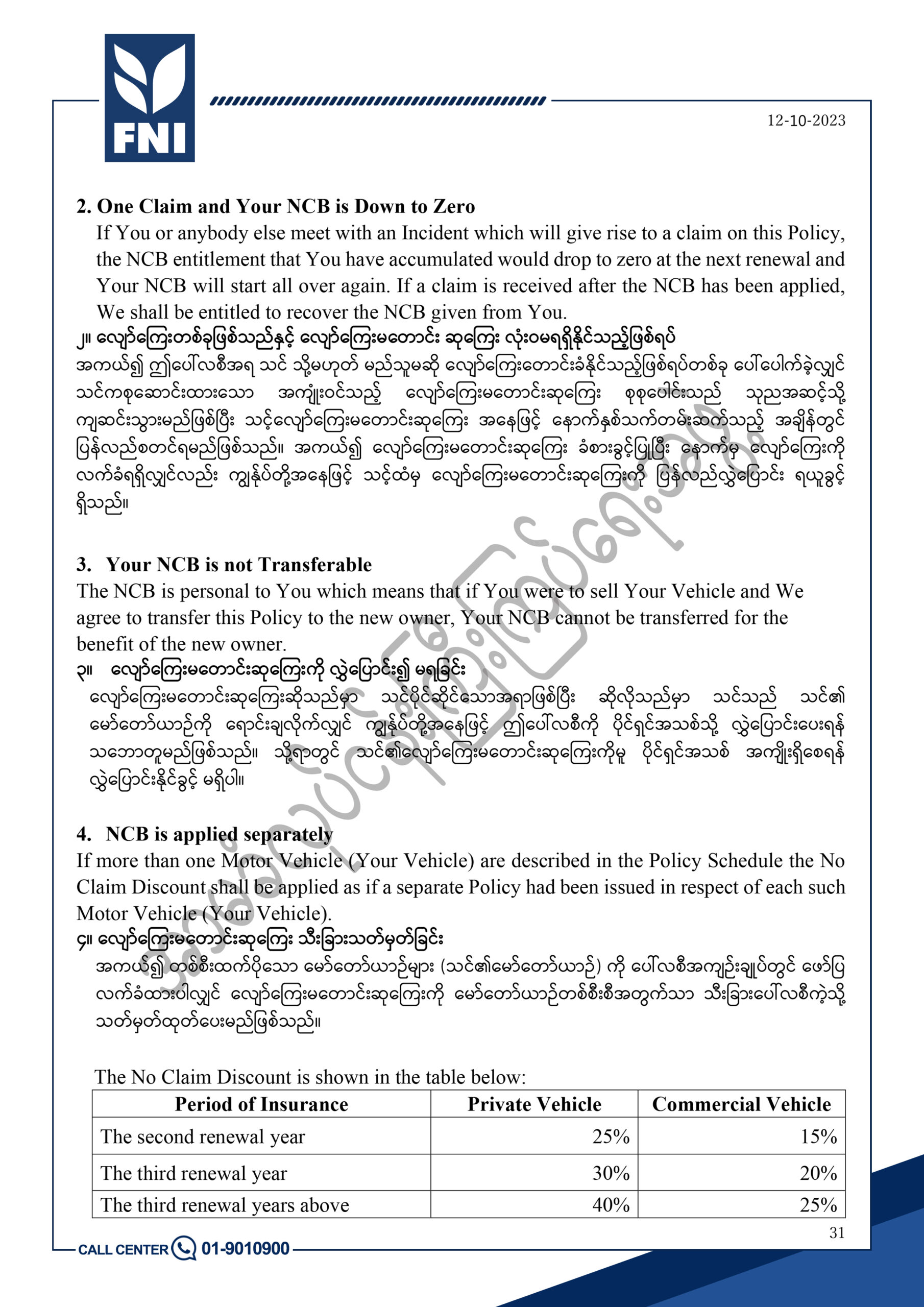

Is there no claims bonus for Motor Vehicle Insurance?

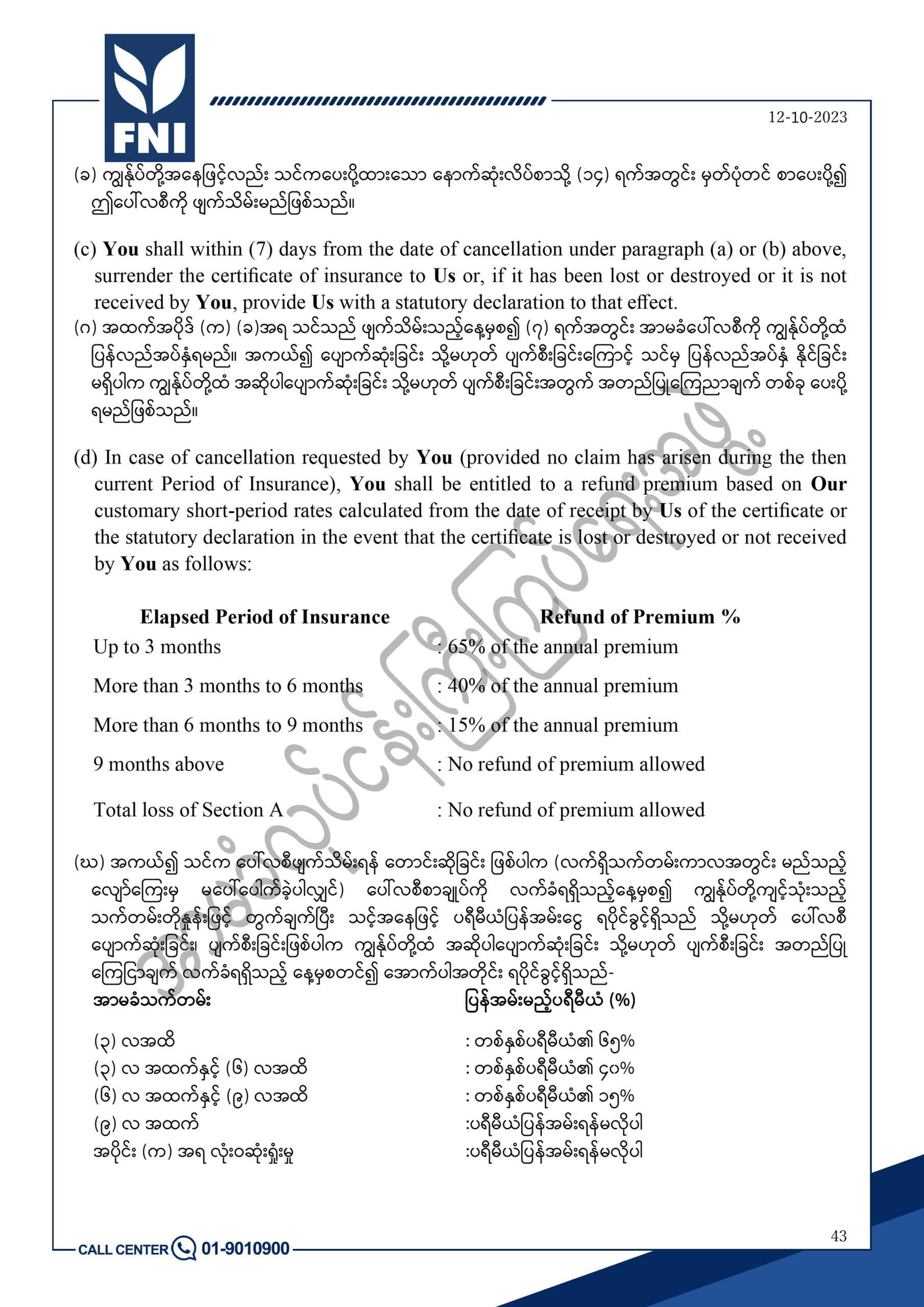

In case there is no claim within the one year period of insurance, for private use (25%, 30%, 40%) and for commercial use (15%, 20%, 25%) percentages will be reduced from the basic premium as No-Claim Bonus on renewal.

How Motor Vehicle Insurance claims are given?

In the case of the total loss (damaged beyond repair) value of the car (not more than the sum insured) will be paid while for a partial loss the damaged part will be repaired or replaced.

Social Vehicle Premium Calculator