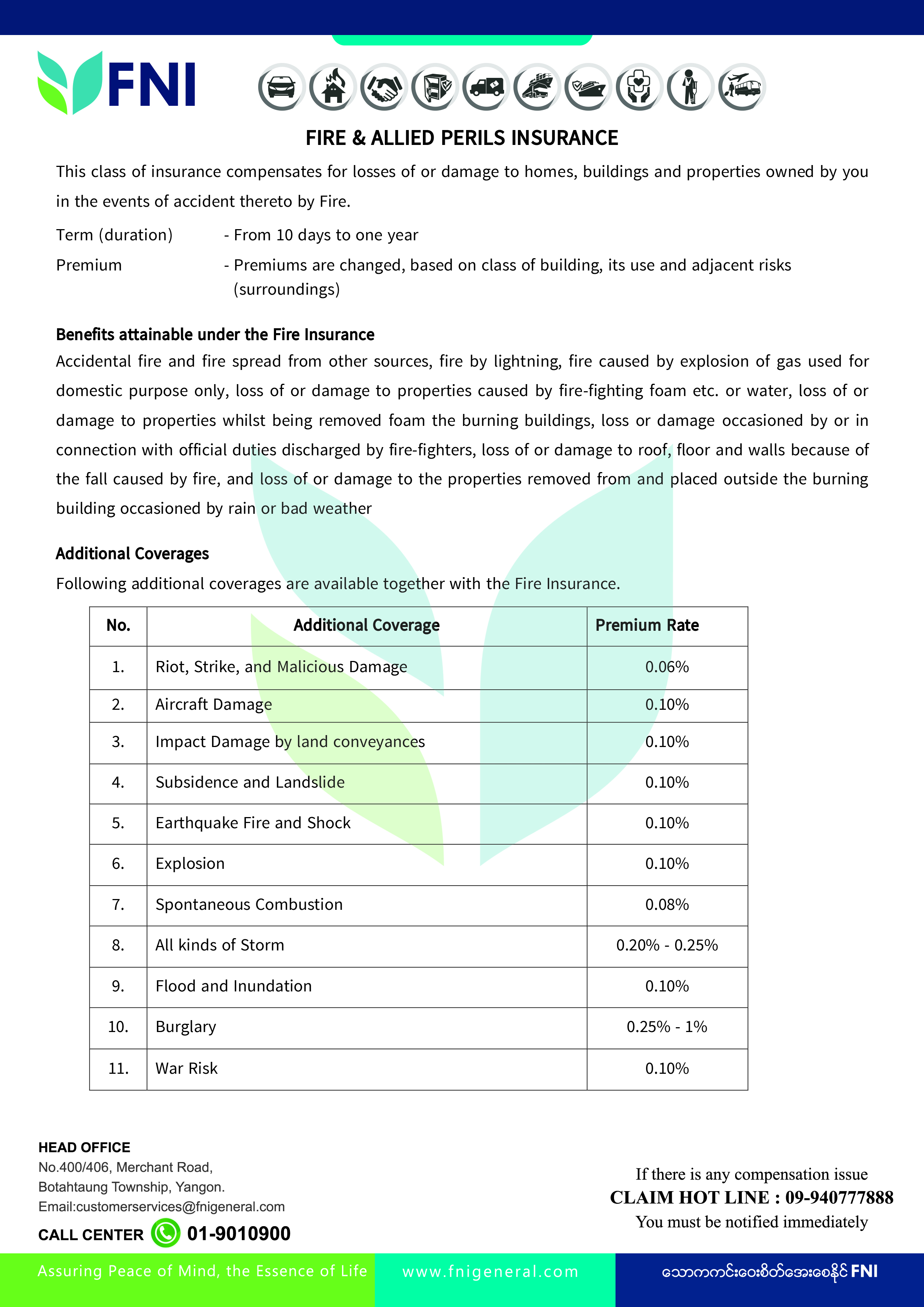

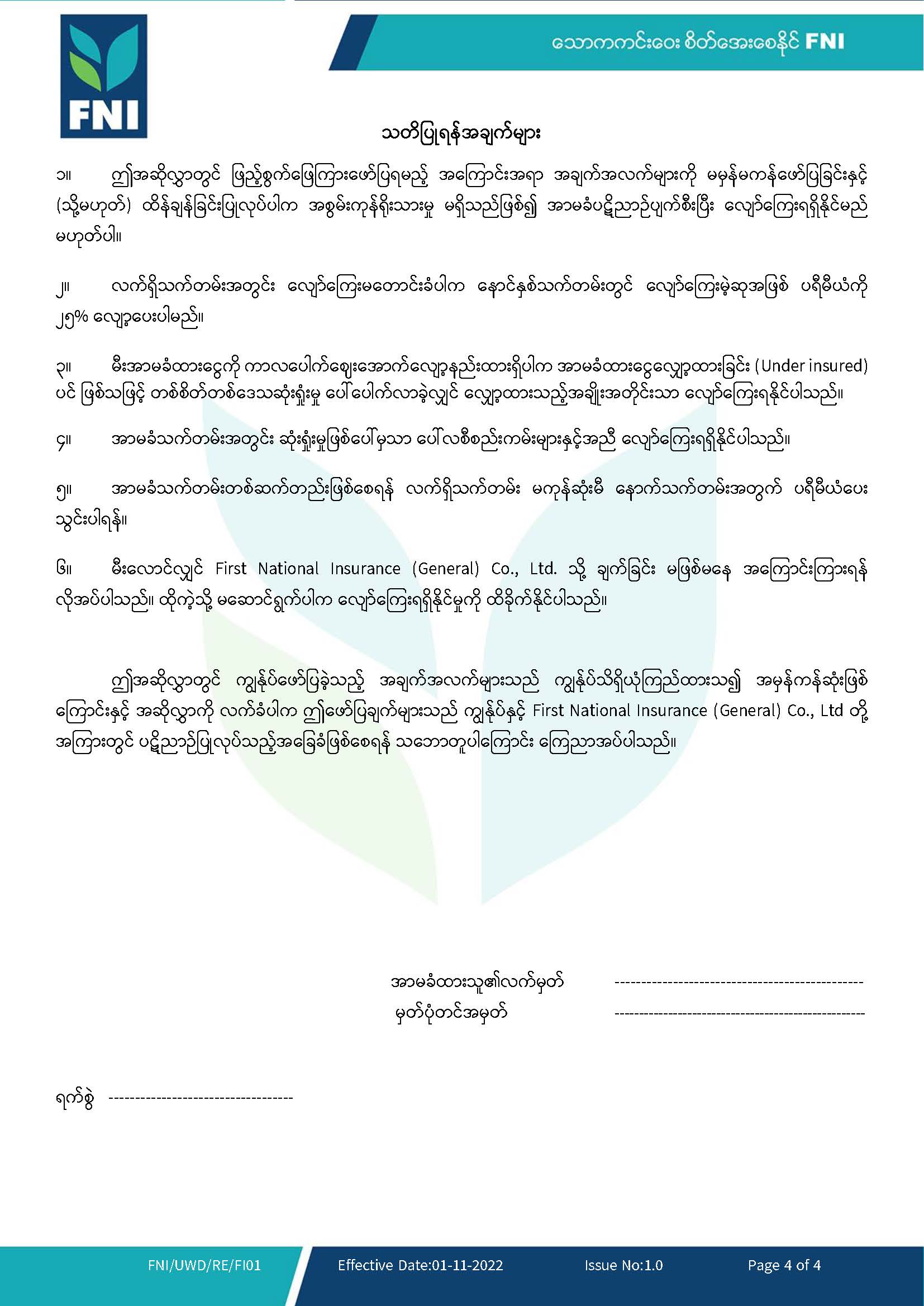

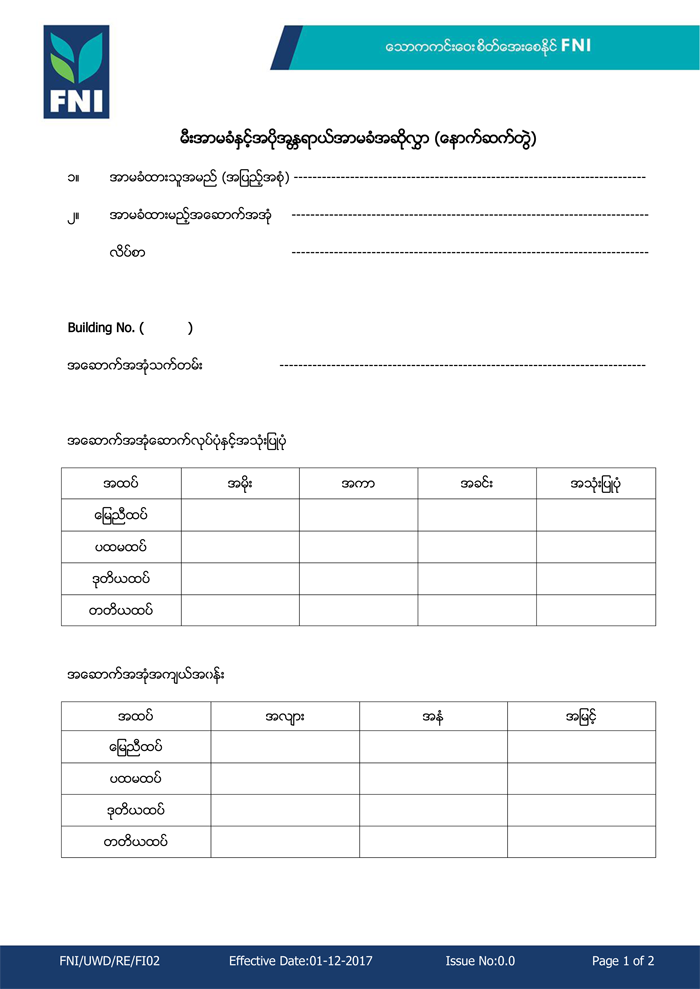

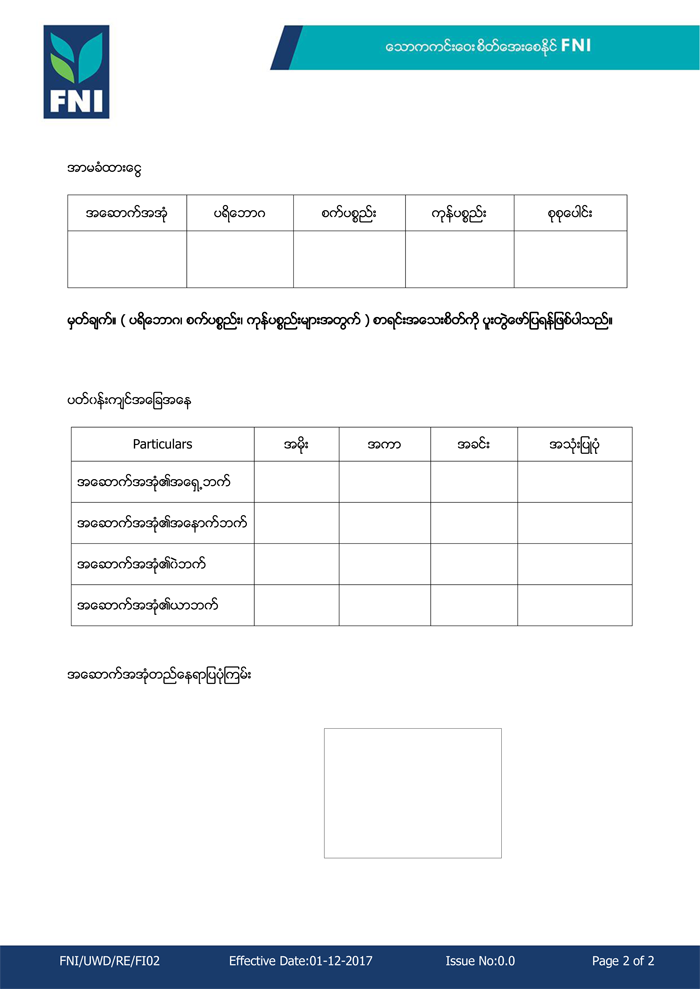

Fire & Allied Perils Insurance

Fire Insurance Policy

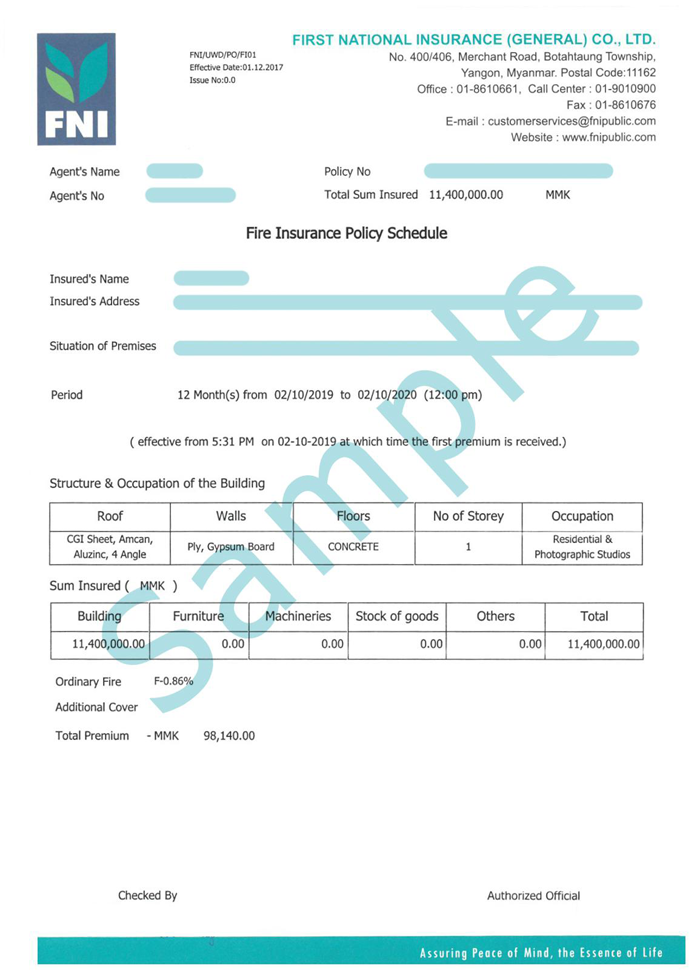

THIS POLICY WITNESSTH THAT in consideration of the sum of premium stated in the Schedule attached, paid to the First National Insurance (General) Company Limited, hereinafter called, “the Company” by the Insured named in the Schedule TO INSURE AGAINST LOSS OF OR DAMAGE BY FIRE OR LIGHTNING to the PROPERTY described in the sum or several sums as per the Schedule, the Company hereby agrees with the Insured subject to the conditions printed on the back hereof and endorsed thereon which are to be taken together as part of the Policy, that if the Property herein described shall be destroyed or damaged by FIRE OR LIGHTNING, the Company shall be liable TO PAY OR MAKE GOOD to the Insured the Value at the time of happening of such loss of the Property so damaged or the Amount of such damage which shall or may happen during the PERIOD OF INSURANCE stated in the Schedule or during any SUBSEQUENT PERIOD for which renewal premium has been received by the Company, not exceeding in respect of the matter or matters above specified the sum or sums set opposite thereto respectively and not exceeding in the whole the sum insured stated in the Schedule.

N.B. Any Warranties to which the Property insured or any item thereof is or at any time be made subject shall attach and continue to be in force during the whole of the currency of the Policy and non-compliance at any time with any of the Warranties shall be a bar to any claim in respect of such Property or item.

Checked By: Authorised Official

Fire Insurance Policy Schedule

Things to do in case of Fire Insurance compensation

| 1. | In the event of a claim, you must notify the following telephone number immediately (if any) | ||

| Claim Hot Line – 09 940777888 | |||

| 2. | Attach the following documents along with the Fire Insurance claim form

|

||

| 3. | In case of damage caused by cyclone (v.strom), monsoon recommendation. | ||

Frequently Asked Questions

Product Video

Copyright © 2024, First National Insurance.

Powered By Aceplus Solutions Co., Ltd.