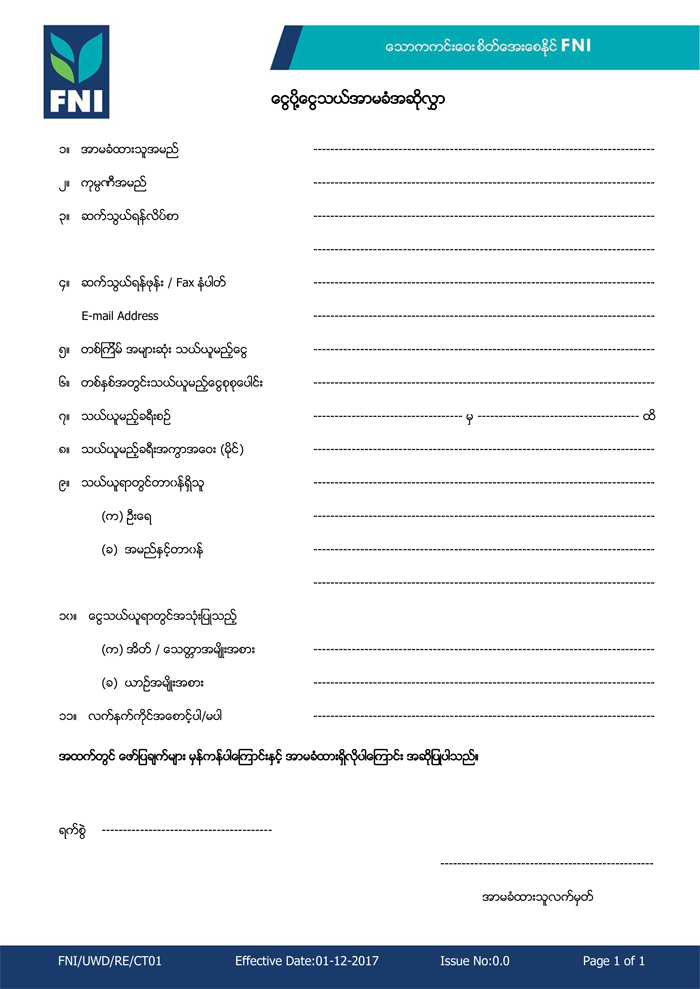

ငွေပို့ငွေသယ် အာမခံ

Cash In Transit Insurance Policy

Whereas the Insured designated in the Schedule hereto has applied to the Company (hereinafter called “the Company” by a Proposal and Declaration (dated as stated in the Schedule hereto) which the Insured has agreed shall be deemed to be of a promissory nature and effect and the basis of this Contract and which is deemed to be incorporated herein and has paid or agreed to pay the premium stated in the Schedule hereto as consideration for the Indemnity hereinafter contained for the PERIOD OF INSURANCE stated in the Schedule hereto.

Now this Policy Witnesseth that the Company will subject to the Terms, Provisions and Conditions contained herein or endorsed hereon indemnify the Insured against the Loss during the said Period or during any Subsequent Period for which the renewal premium has been received by the Company of Money i.e, Cash and / or Notes occasioned by Robbery or Theft or any other cause whatsoever whilst IN TRANSIT as described in the Schedule hereto.

Provided that the Company’s liability is limited in respect of any one loss to the sum or sums stated in the Schedule hereto.

Provided also that the Company shall not be liable for any loss directly or indirectly, proximately or remotely occasioned by contributed to by or traceable to or arising out of or in connection with Earthquake, Volcanic Eruption, Flood, Typhoon, Hurricane, Tornado, Cyclone or other convulsion of nature or atmospheric disturbance, War, Invasion, the Art of Foreign Enemy, Hostilities or Warlike operations (whether war be declared or not), Mutiny, Riot, Civil Commotion, Insurrection, Rebellion, Conspiracy, Military, Naval or Usurped power, Martial Law or State of Siege or any of the events or causes which determine the proclamation or maintenance of Martial Law or State of Siege or by any direct or indirect consequences of any of the said occurrences and in the event of any claim hereunder the Insured shall prove that the loss arose independently of and war in no way connected with or occasioned by or contributed to by or traceable to any of the said occurrences or any consequences thereof and in default of such proof the Company shall not be liable to make any payment in respect of such claim.

In any action, suit or other proceeding where the Company alleges that by reason of the provisions of this condition, any loss or damage is not covered by this insurance, the burden of proving that such loss or damage is covered shall be upon the Insured.

Provided Further that the due observance and fulfillment of the Terms, Provisions, Conditions and Endorsements of this Policy by the Insured in so far as they relate to anything to be done or complied with by the Insured shall be conditions precedent to any liability of the Company under this Policy and in this respect time shall be the essence of the contract.

Conditions

- All Notices and Communication in relation to this Policy are to be sent in writing to the Company or to the Agent of the Company with whom the Insured has been in communication. No receipt for renewal premium is valid except on the Official form issued by the Company and no endorsement on this Policy or alteration in the terms thereof is valid unless countersigned by authorized Official of the Company or by an Agent acting under Power of Attorney from the Company.

- If any statement in the proposal of the Insured is untrue in any material respect or if any claim made shall be fraudulent or intentionally exaggerated or if any false declaration or statement shall be made in support thereof or if any book showing the amount of money in transit insured by this Policy during the period of insurance shall not have been duly and correctly kept, then the Company shall be no liability.

- The Insured shall immediately upon the discovery of any loss give notice thereof in writing to the Company and shall deliver to the Company detailed statement of the claim and shall furnish all such explanations, vouchers, books, proof of ownership and other evidence as may be required to substantiate the claim and shall if required make statutory declaration of the truth of the Claim and shall at once take all practicable steps for discovering and punishing the guilty person or persons and for tracing and subsisting any other insurance of any nature whatsoever covering the same whether effected by the Insured or not, then the Company shall not be liable to pay or contribute more than its ratable proportion of such loss.

- The Company shall without thereby being held to admit any claim be entitled at any time in the Company’s own or the Insured’s name to take steps for the recovery of any money claimed for and the Insured shall be bound to give the Company all information and reasonable assistance so doing. The Insured may also be required as a condition of any settlement of any claim shall be the property of the Company, not exceeding however the amount paid by the Company.

- The Company shall not be bound to accept any renewal premium, and give notice that such is due. The Company may at any time by notice to the Insured cancel the policy as from seven days after the date, when the Insured should receive such notice in the ordinary course of post subject and without prejudice to any rights or claims either of the Company or the Insured arising under the Policy prior to that premium for the period form the commencement of the then current period of Insurance to the date to the date of such cancellation shall be regulated as provided in condition 6 below.

- The first premium and all renewal premiums that may be accepted are to be regulated by the amount of cash and / or notes as insured herein and a proper record shall be kept in the books of the Insured of all the money so insured. The Insured shall at all times allow the Company to inspect such books and within one month from the expiry of the period of insurance shall supply the Company with correct account of all the money in transit insured by this Policy during the said period. If the ascertained amount shall differ from the estimated amount on which premium has been paid, the difference in premium shall be met by a further proportionate payment to the Company or by a refund by the Company as the case maybe.

- If any dispute shall arise as to whether the Company is liable under this Policy or as to the amount of its liability, the matter shall be referred to the disagree, of an Umpire who shall be appointed by the said Arbitrators before entering on the reference and in case the Insured or his legal personal representatives shall neglect or refuse for the of two calendar months after request in writing form the Company so to do to name an Arbitrator, the Arbitrator of the Company may proceed alone and no action or proceeding shall be brought to prosecuted on this Policy until the award of the Arbitrators, Arbitrator or Umpire has been first obtained. The costs of and connected with the Arbitration shall be in the discretion of the Arbitrators, Arbitrator or Umpire.

- If the Company shall disclaim liability to the Insured for any claim hereunder and such claim shall not within twelve calendar months from the date of such disclaimer have referred to Arbitration under the provisions herein contained and no notice thereof shall have been received by the Company from the Insured within the said period of twelve calendar months, then the claim shall for all purposes be deemed to have been abandoned and shall not thereafter be recoverable hereunder.

ငွေပို့ငွေသယ်အာမခံလျော်ကြေးပေါ်ပေါက်လာပါကဆောင်ရွက်ရမည့်အချက်များ

| (၁)

|

လျော်ကြေးပေါ်ပေါက်ပါကအောက်ပါဖုန်းနံပါတ်သို့ ကနဦးချက်ချင်း(ဖြစ်လျှင်ဖြစ်ချင်း)အကြောင်းကြားရပါမည်။

သတင်းပို့ရန် ဖုန်းနံပါတ် – Claim Hot Line – 09 940777888 |

| (၂) | ငွေပို့ငွေသယ်အာမခံ လျော်ကြေးတောင်းခံလွှာနှင့်အတူ အောက်ပါအထောက်အထားများ ပူးတွဲတင်ပြရန်။ |

| (က)ငွေစတင်သယ်ဆောင်သည့်နေရာမှ ငွေမည်မျှသယ်သွားကြောင်းအထောက်အထား | |

| (ခ)ငွေမည်မျှလုယက်ခံရကြောင်း/ ခိုးယူခံရကြောင်း ပြည်သူ့ရဲတပ်ဖွဲ့၏ထောက်ခံချက် |

Frequently Asked Questions

coming soon!